Who we are

Who we are

Complete FRM Solution Provider

Cumulative Experience

Served

Building financial resilience – Almus provides complete Financial Risk Management (FRM) solutions.

Monthly Market Webisode

insights

Cost of RBI FX Intervention

Between November 2024 and February 2025, the Reserve Bank of India (RBI) took significant measures to manage rupee volatility, including selling billions in reserves, conducting FX swaps, and infusing liquidity through open market operations. With forex reserves depleting and the rupee hitting record lows, what are the long-term implications of such interventions?

How We Work

How we work

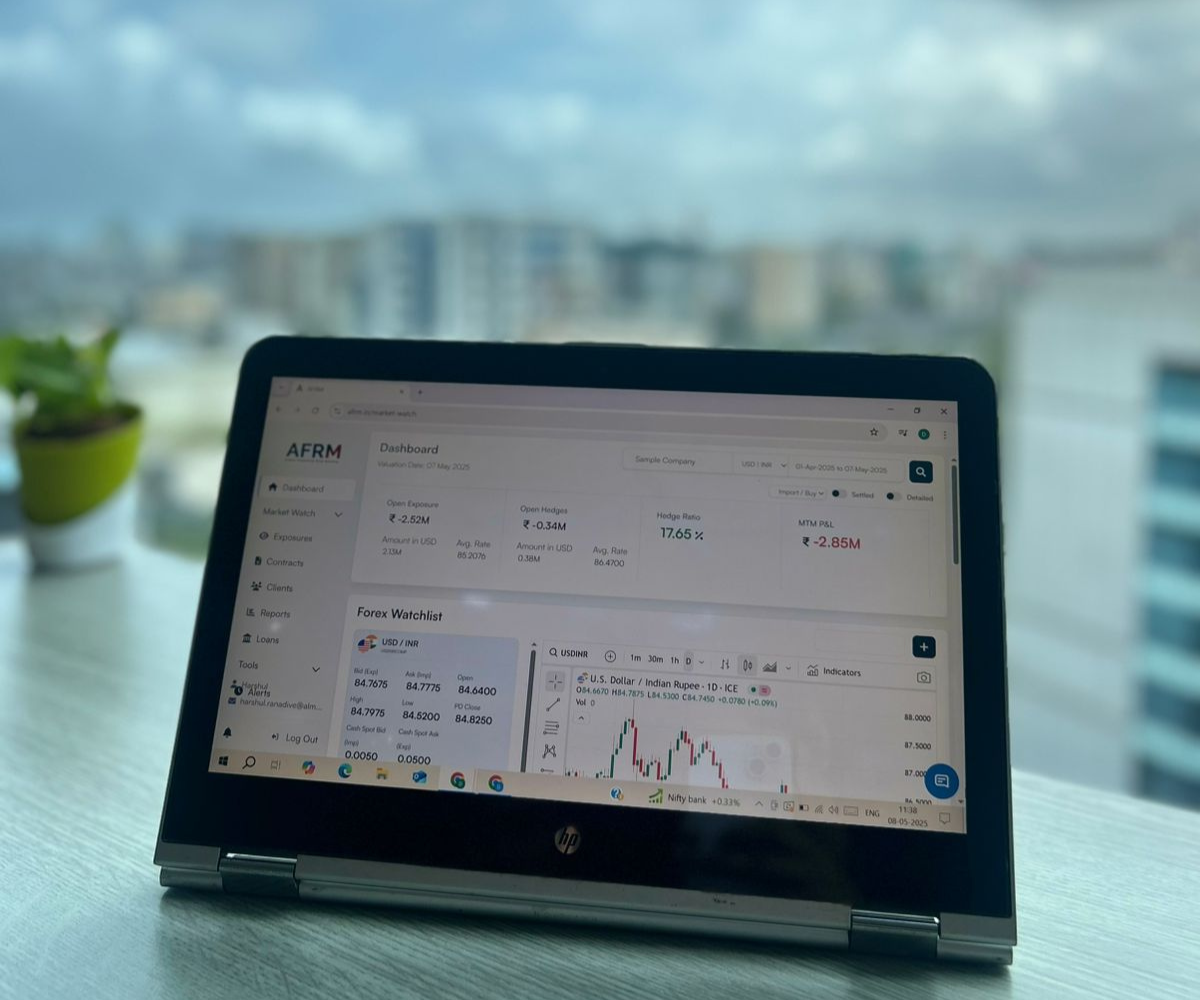

Treasury Management System

Our robust Treasury Management System enhances efficiency and control over financial operations, ensuring seamless management of financial risk.

- Risk management processes to mitigate exposure.

- Customized reporting and analytics for informed decision-making.

- Performance Measurement.

Research and Market Intelligence

Gain a competitive edge with our comprehensive Research and Market Intelligence services, providing deep insights and analysis to navigate volatile markets and make informed decisions.

- In-depth analysis of macroeconomic trends and market dynamics.

- Customized research reports tailored to specific client needs.

- Regular market updates and insights delivered via multiple channels.

In-house Dealing Room

Experience the power of our state-of-the-art In-house Dealing Room powered by a Reuters Screen, equipped with best-in-class technology and expert professionals, facilitating swift and secure transactions while optimizing hedging strategies.

- Live access to global financial markets and exchanges.

- Execution of trades across a wide range of financial instruments.

- Risk management tools to monitor and control exposure levels.

Why choose us

Why Choose Us

Why Choose Us

How We Help

Re-Gain Control

Protect the Bottom Line

Improve cashflow management

Grow Your Business

Insights

Latest Articles

Milestones

Milestones

Celebrating decades of Excellence

FX Outsourcing

FX Advisory

We expanded our offerings to include Advisory services, broadening our scope to provide strategic guidance and insights.

FRM Consulting

Taking another leap forward, we introduced Consulting services, enabling us to offer comprehensive solutions tailored to the specific needs of each client.

Interest Rate Risk Management

Commodity Risk Management

Financial Resilience

Risk Management

Market Insights

Testimonials

Testimonials

What Our Clients Say about us

I want to compliment MS and his team for guiding us since the past 3 years. Almus has helped us in drafting our hedging policy. We are very happy working with them.

Sanjay Banka

For me and Rosy Blue, Almus is not a consultant but our partner. They own both – our issue and the solutions they provide. With an ideal mix of youth and experience, theory and practical, conservatism and progressiveness, they help us manage the uncertain and volatile time as an owner of the business.

Russell Mehta

In Almus, we have the partner that supports us in diligently managing our foreign currency exposures; this partnership was important in redefining our currency risk management strategy and implementation thereof. We are now able to manage currency risk on an everyday basis more efficiently and importantly monitor treasury performance.

Rajesh B. Rathi

Almus updates us on what is happening in the international business or foreign exchange. We deeply appreciate the professional services that have always exceeded our expectations and helped us in fostering a strong partnership with them.

Nitin Agarwal

We have been engaged with Almus right from the time of policy framing to policy implementation, the experience has been very good in terms of executing what we have been agreed upon and it is visible in the kind of hedging in our open exposure. The team is fantastic and I hope the support will continue in the coming days.

Anand Gupta

Clients Served

kaleesuvari

euro-fruits

sansera

samarth-diamond

jasani

Mytrah_logo