Key Policy Changes

• Policy Repo Rate: Unchanged at 5.50%

• Standing Deposit Facility (SDF): Maintained at 5.25%

• Marginal Standing Facility (MSF) & Bank Rate: Held at 5.75%

• Monetary Stance: Neutral (though 2 members preferred a shift to accommodative)

• Decision: Unanimous on holding rates; divergence only on stance.

Economic Outlook

Growth Assessment:

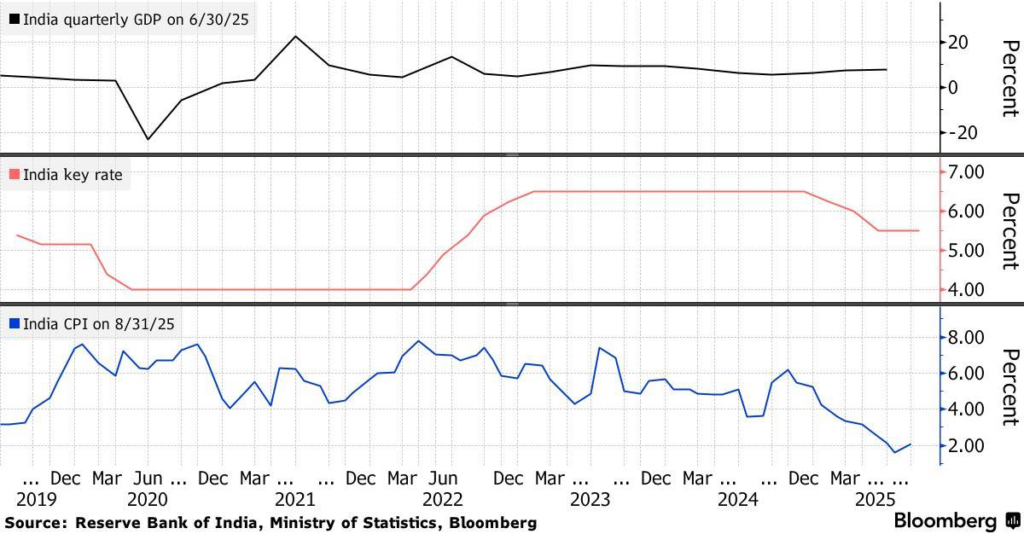

‐ Q1 FY2025-26 GDP growth at 7.8%, driven by manufacturing revival and services expansion.

‐ Public investment robust; government (central and states) revenue expenditure growth and private consumption also supportive.

‐ Rural resilience supported by above-normal monsoon, high kharif sowing, and improved reservoir levels.

‐ Services sector buoyant, with Services PMI at 62.9 in August 2025 (a 15-year high) and Manufacturing PMI at 59.3 (17.5-year high).

‐ However, global trade tensions, uneven external demand, and tariff-related uncertainties present downside risks.

‐ GDP Projection FY2025-26: 6.8% (Q2: 7.0%, Q3: 6.4%, Q4: 6.2%) and Q1 FY2026-27: 6.4%

• Inflation Management:

‐ CPI Inflation hit an eight-year low of 1.6% in July 2025 and rose modestly to 2.1% in August, mainly due to a sharp fall in food inflation and rationalized GST rates.

‐ Core inflation remained steady at 4.2% as of August.

‐ Inflation Projection FY2025-26: 2.6% (Q2: 1.8%, Q3: 1.8%, Q4: 4.0%) and Q1 FY2026-27: 4.5%

Liquidity and Transmission

• Liquidity surplus: System liquidity averaged ₹2.1 lakh crore/day since the last MPC (lower than in prior months), with recent and upcoming CRR cuts expected to further support liquidity.

• Significant transmission of rate cuts: Weighted Average Call Rate (WACR) fell by 92 bps; 3-month T-bill, CP, and CD rates declined by 105–147 bps; lending rates on new rupee loans down by 58 bps and deposit rates down by 106 bps for fresh deposits.

• Internal Working Group recommended retaining WACR as the operating target and continuing with variable rate auctions.

External Sector

• Current Account Deficit (CAD) moderated to 0.2% of GDP in Q1 2025-26 (US$2.4 billion), supported by robust net services export growth and strong remittances even with an elevated merchandise trade deficit.

• Services exports grew 6.5% in July-August 2025; India’s share in global services trade and remittances remain high.

• Gross FDI inflows rose by 33% YoY in April–July 2025; net FDI reached a 38-month high (over 200% increase compared to previous year); net FPI outflows of US$3.9 billion in FY 2025-26 so far (Apr–Sep).

• Forex reserves at US$700.2 billion as of September 26, 2025, covering more than 11 months of imports.

Effects on Financial Markets

• Equity Markets: Positive sentiment expected as benign inflation and stable rates boost earnings outlook; corporate profitability should improve as borrowing costs fall.

• Debt Markets: Government bond yields declined due to policy cut transmission; corporate bond yields also fell. Indian bond market performance stands out globally in 2025 easing cycle; neutral stance and liquidity support to favour bond prices.

• Forex Markets: INR has seen depreciation and volatility despite robust macro fundamentals; forex reserves are strong, and CAD is low, but FPI outflows and global trade tensions weigh on INR.

Additional Regulatory and Structural Measures

• Expected Credit Loss framework for banks (excluding SFBs, PBs, RRBs, AIFIs) to take effect from April 2027, with a glide path until March 2031.

• Revised Basel III capital adequacy norms effective from April 2027; draft circulars and further relaxations for MSME and home loan segments.

• Expanded scope for lending, capital markets, and reforms to improve credit flow and ease of doing business.

• Steps to internationalize the Indian Rupee and streamline FEMA/ECB regulations announced.

Rationale for Policy

• Inflation outlook has moderated further; FY2025-26 inflation revised down from 3.7% (June) and 3.1% (August) to 2.6%.

• Growth remains resilient, supported by domestic drivers and GST reforms.

• However, global uncertainties and tariff-related developments weigh on outlook.

• Policy space exists, but RBI opts to wait-and-watch as transmission of earlier easing and fiscal measures is still playing out.

• Hence, repo held steady at 5.5%, stance neutral (though 2 members argued for accommodative).

Our View:

The October MPC outcome is marked by policy continuity, but beneath the surface it highlights a growing case for an accommodative stance. Inflation has plunged to multi-year lows well below the RBI’s 4% target and comfortably within the tolerance band. Even after accounting for base effects and seasonal pressures, the FY2025-26 inflation projection at 2.6% is among the lowest in decades.

On the growth front, while Q1 GDP growth at 7.8% looks impressive, the trajectory moderates to 6.4% in H2 FY2025-26. External demand is fragile due to tariff uncertainties, global financial volatility, and prolonged geopolitical tensions. Domestic consumption and investment remain resilient, but sustaining momentum will require continued policy support.

Against this backdrop, maintaining a neutral stance may appear conservative. With inflation providing ample policy space and global central banks turning more flexible in the face of growth headwinds, India could adopt an explicitly accommodative stance to reinforce the transmission of earlier easing and to anchor market expectations. This would not necessarily mean immediate rate cuts, but rather a clear policy signal that the balance of risks favors growth support.

The RBI has reiterated that it is keeping a close watch on the rupee movement and stands ready to take necessary steps to preserve orderly market conditions. This is significant because the environment remains fragile with FPI outflows in debt, and tariff-driven trade headwinds all create pressure points

So far, the RBI’s approach has been measured intervention leaning against excessive volatility and smoothing large intraday moves, rather than defending any specific level. This strategy has allowed the rupee to adjust in line with fundamentals, while preventing disorderly depreciation that could destabilize markets or inflation expectations. Looking ahead, the key question is whether the RBI will continue with this current policy of calibrated intervention or adopt a more aggressive approach if the currency faces sustained pressure.

Made By:

•

Jayaram Krishnamurthy Founding Partner & Head Research and Advisory

•

Madhav Bhatia Senior Analyst Consulting