“History provides a crucial insight regarding market crises: they are inevitable, painful and ultimately surmountable.” -Shelby M.C. Davis

The month was dominated by news on Central Bank policy meetings and it did turn out to be a historic month when one major Central Bank reverted from loose policy to tightening and another vice versa. While most others-maintained status quo, interest surrounded their forward guidance and projections.

Japan moved out of negative interest policy and ended their ETF buying programme, but monthly QE amount was retained at USD 4 bio. The decision came after Government’s assessment that the country was seen coming out of deflation and also wage negotiations were strong enough to push demand higher. The move was not a total surprise and some agencies had been already indicated the same. But the move by Swiss National Bank to cut their policy rate from 1.75% to 1.5% was least expected but was justified by the inflation development in the economy. Yearly inflation had consistently fallen below 2% target which supported the decision.

The most focus was of course on the Fed meeting, where debate was whether they would continue to project 3 rate cuts this year or reduce it 2 in view of the recent higher CPI and PPI inflation numbers. However, by a slim majority the dot plot again indicated 3 rate cuts in 2024, although the timing of the first cut was not clear. FED Chairman’s press conference did not contain any surprises but he did hint that they would be inclined to cut if the job market weakened further.

Among other Central Banks, European, UK and Australian Central Banks held rates unchanged. From the statements by the respective Central Bank Chiefs one can deduce that they are all set to cut rates in June this year. Inflation development in Europe and UK support the same, while in Australia they maintained that policy could go either way depending on data.

Some of the EM Central Bank rate decisions were noteworthy. Turkey hiked their rate by another 5% to take it to 50% (their inflation is over 60%), Brazil cut rate for the 6th time after peak rate of 13.75% was seen from August 2022 to August 2023, while Mexico cut interest by 0.25% for the first time from after rates peaked at 11.25% from March 2023,

The major themes that guided the markets were-

1. Despite uncertainty about Fed rate cut timing and quantum, risk assets had a strong performance, which in a way kept the financial conditions easy

2. U.S. economic data broadly remaining strong and CPI inflation remaining sticky well above 3% kept FED speakers guarded about cutting rates soon, even the rate cut expectations in June swung from above 80% probability to 60%

3. Apart from Fed dot plot, market was looking for clues on reducing pace of Quantitative Tightening by the Fed

4. Europe and UK inflation were dropping much faster giving a sense that they were much certain to cut rates in June

5. Europe showed nascent signs of recovery and forward looking surveys were steadily improving

6. China was the other economy to show signs of bottoming with manufacturing and services PMIs moving into expansion

7. Japanese Yen remained near four decades low of 152 despite Japan moving away from negative interest rate policy

8. Market remained on intervention alert from Japanese authorities

9. China Yuan also remained on focus as fallout of continued weakness in Yen with market not ruling out a fresh currency war emerging

10. Commodities in general were well supported due to signs of recovery in Europe and China

11. Gold’s rise of over 25% in last six months and half of it in the month of March surprised many as US economy continued to be strong, yields were still rising and early rate cut hopes were fading

12. Gold’s rise also kept any Dollar bullish action in check

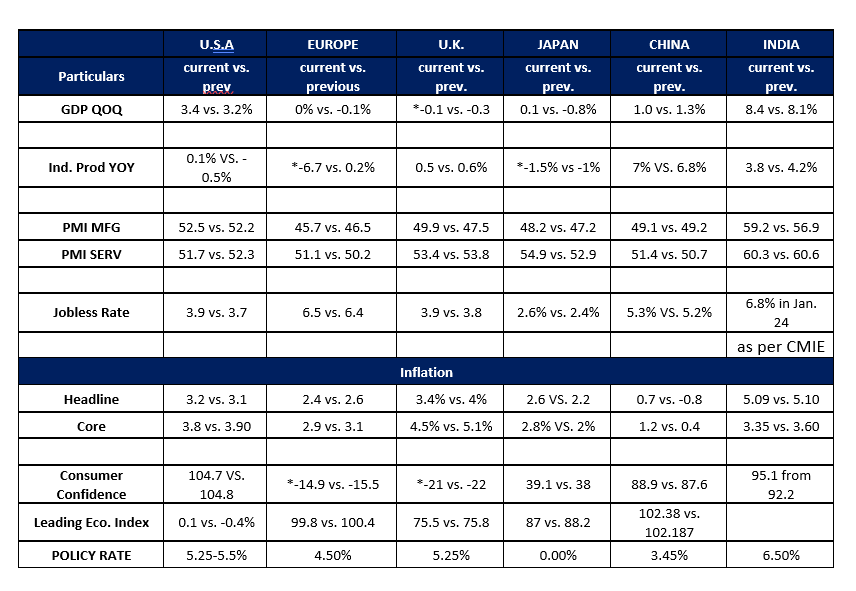

KEY ECONOMIC DATA FOR MAJOR COUNTRIES

U.S. exceptionalism continued to be reflected in the economic data published, including GDP, Housing sector and consumption, and even leading indicator slightly improved (first time in six months). Consumer sentiment improved while inflation expectation eased.

European and UK data was mixed but inflation declined which improved overall outlook due to possibility of rate cuts. Froward looking ZEW and IFO surveys in Germany pointed to economic on the way to recovery. Japanese inflation drifted down, but was well above their 2% target. However, they continued with accommodative stance. China’s cyclical indicators were better, but structural issues like Real Estate, Debt and tech sector woes continue. Chinese Central Bank did not cut the medium-term lending rate as was widely expected, but continued to infuse liquidity.

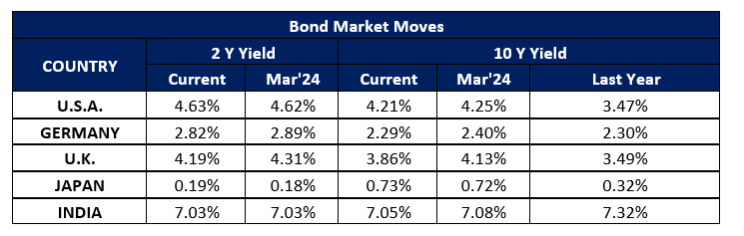

BOND MARKET: Bond yields in major economies moved in a range awaiting more clues on monetary policy easing. U.S. yields remained well supported as inflation remained sticky and FED members continued to express reservations about hurrying to cut rates, though dot plot continued to indicate three rate cuts.

Due to quarter ending, there was strong demand for Government bonds which kept the yields in check. Japanese Yields moved higher after the Central Bank came out of negative interest rate policy. Despite huge inflows for bonds, yields in India remained in a very narrow range.

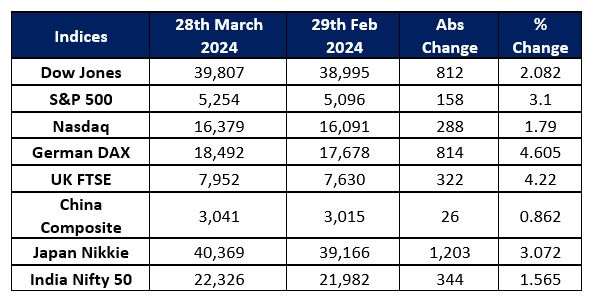

Equity Markets: Major markets across the globe hit fresh all-time highs again in March as hopes of rate cuts amid stable economies encouraged investors. In the U.S. tech sector led the gains and continued carry trade with Yen also added to the momentum.

S&P 500 was in best stretch without a 2% decline since 2018, up over 40% in the last 12 months, more than one standard deviation above the long-run mean of 36%. Japanese market crossed the magical 40000 mark while China market stalled after its impressive recovery in January. While the view has been that valuation concerns and due to quarter end repatriations, the markets should drag down but that did not impact. Abundance of liquidity is still driving the market (Japan has continued with its QE), though it is understood that cash holding among large institutions is at record level, which indicates a cautious stance.

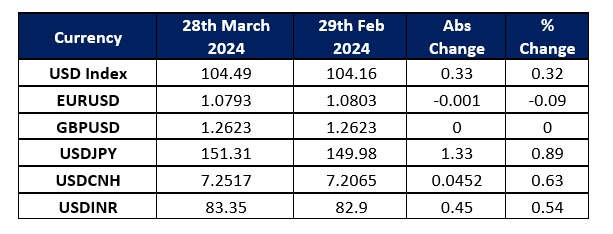

Currency Markets: After an initial dip to 102.36, a near 2% recovery in the Dollar Index was observed after steady stream of positive data and sticky inflation gave a sense to investors that rate cuts may not happen in a hurry in US while others may be closer.

USDJPY made the largest % gain during the month and weakened more after Japan shifted to 0% rate from negative, as it was a well anticipated move and market was positioned for a sell-off in the Dollar that did not materialize.

AS USDJPY reached four decades high of 151.97, question among market participants is whether Japan will actually intervene by selling Dollars as they did in the year 2022 aggressively or more passively in 2023. Expectations are that authorities are quite consistently protecting the level of 152 and sending strong messages, although market has not reacted much unless an actual intervention is seen. With markets much bigger than earlier, Japanese authorities may stick with verbal intervention until market breaks 152 and moves towards 153 with a sense of complacency.

EURUSD, though remaining supported on dips, is unable to build on rallies despite benefitting from good demand for sovereign bonds of countries in the region. Investors look for more consistent recovery in Europe to break out of the long-held range.

Outlook: Global

The emerging view of U.S. Exceptionalism to take a backseat as more and more data is coming on the slowing side. Eventually FED will cut rates as soon economy experiences recessionary tendency. The structural deficit of USA (Debt to GDP of 135%), fiscal deficit of 6.5% and trade/current account deficits make it vulnerable without foreign funding. Any monetisation of debt due to lower foreigner demand will weaken the Dollar substantially. Thus, both structural and cyclical factors are turning against the Dollar.

Expect Dollar Index to break 102.50 in the coming days/weeks setting up a retest of 100 psychological marks. Accordingly, EURO should move towards 1.12, JPY towards 145 and GBP towards 1.30.

Dollar continues to remain supported due to its exceptional growth and high yield attraction, whereas other in other major countries growth is tepid and inflation is dropping. However, there’s a sense that market is structurally positioned long Dollar for some while and it’s likely to be reversed gradually as more and more Dollars are diversified into other assets. The structural issue of big deficits and unsustainably high Debt/GDP ratio in U.S will eventually bring down the Dollar. Its already showing signs of the same through the Gold rally in the last few months.

Japanese intervention is only a matter of time and level could be a matter of speculation, as further weakness in Yen could be seen as threatening macro stability besides evoking competitive devaluations from other countries in the region. An effective intervention, as and when it comes, will have the potential to push USDJPY towards 140 while having a weakening effect on overall Dollar.

RATE CUTS IN U.S. WILL BE THE INFLECTION POINT FOR THE DOLLAR.

Indian Markets:

Key themes/market drivers in India –

1. Continued large flows from foreigners. Overseas investors have bought around 815 billion rupees (about $9.9 billion) of Indian government bonds since the announcement, and sentiment was also aided when Bloomberg Index Services said last week it will include the bonds from 2025.

2. Narrowing current account deficit (1.2% in Q3 of FY24) compared to 2.1% in corresponding period previous FY. Considering the large inflows expected and the lower trade deficit, a healthy BOP surplus for the year can be expected, which should remove any concerns about the Dollar/Rupee exchange rate

3. India’s FX Reserves hit a new high of USD 643 bio as per the latest data giving a huge comfort to RBI’s aim of keeping stable exchange rate

4. Continued high growth rate will likely attract more FDI flows during FY 25 once a stable Government is in place, as widely expected

5. India’s manufacturing PMI continued in expansion territory and hit highest level since 2008 in March

6. Inflation was contained near 5% (RBI target 4%), but RBI unlikely to change its policy or stance near term

7. Rupee moved out of its long held range of 82.70 and 83.20 when hit by large FDI outflows followed by Chinese Yuan weakness and spike in oil price

Outlook: India

Expect Rupee to trade in a weaker range in the weeks ahead due to following reasons-

1. Lull in the foreign fund flows ahead of the general elections

2. Higher oil prices keeping the sentiment weak

3. Yuan likely to remain weak based on Chinese fundamentals and reacting to the sustained weakness of the Yen, unless reversed by official intervention

4. Upcoming policy by RBI is likely to be a status quo event and no rate cut expected until last quarter of 2023 and, in any case, not before FED eases

5. Any large sell off in Japanese Yan may result in general unwinding of risk assets globally which can affect Indian markets and Indian Rupee as well

6. Indian benchmark yield expected to remain steady around 6.95 – 7.15 range

USDINR Range expected should be between 83.00 to 84.20 for the month

Technical Outlook

USDINR CMP 83.4475

USDINR broke out of its narrow range as the central bank decides to widen the range. It also broke the pattern of lower monthly high after 4 months thereby raising alerts for USDINR upside moves. USDINR all time high is still being protected but a break above the same should bring further upside move as experienced last month after market hours with USDINR reaching as high as Rs. 83.70+ levels. Break of Rs. 83.50 should bring in newer targets at Rs. 83.80 initially and then Rs. 84.20.

Downside moves if any should find supports at Rs. 83.30 initially followed by Rs. 83.00/83.05. Current bias remained slightly tilted for a move upside but holding of Rs. 83.50 levels for another week should shift this inclination suggesting strength & consistency shown in protecting those levels by the central bank. Currencies although continue to move in ranged action and directional action should further provide major moves.

Commodity Outlook (Gold)

GOLD: COMEX: XAUUSD: CMP: USD 2294

Gold moved as mentioned in previous reports after the break of USD 2070 levels held for years as multiple tops. Minor corrections did not sustain longer and March itself saw huge move on the upside for the metal prices. Targets mentioned in previous reports have been reached while it continues to prepare for new targets to be achieved.

Expect small correction to USD 2260 initially while a bit more stretched correction if observed can be towards USD 2205. Momentum still continues to be on the higher side but slowing of the momentum can be seen by the end of the month. Upside resistance for gold at USD 2410/2420 should hold upside action for the time being.

GOLD: MCX Gold (Feb): CMP: INR 69,800

The yellow metal against INR on MCX continued making new highs in the past few days trading reaching INR 70,000 levels. The recent rally has been quite one sided with barely any corrections in the past weeks, raising possibility of correction as the charts looks slightly overdone in the shorter time frame. Corrections towards INR 68,200 can be anticipated though the current momentum keeps possibility of these limited. A stretched correction if any should be seen towards INR 66,900 (less likely). On the upside the resistances can be seen towards INR 72,400.

Prepared by:

Mr. Jayaram Krishnamurthy,

Co-Founder and COO – Almus Risk Consulting LLP

Mr. Shikhar Garg,

VP – Treasury Markets – Almus Risk Consulting LLP