The month of November can be described as the month of great deceleration globally which was a relief to all stake-holders – policymakers, investors and general public. Inflation, which had been falling in the past few months, got some momentum on the downside and came lower than expected in most major economies. This meant that the policy rate hikes that Central Banks had done over the past 18 months had their desired effect though with a lag. However, while the markets took the development with both hands and rallied across all segments, Central Bank speakers continue to adopt a cautious line and were pushing back against market expectation of timing & extent of rate hikes in the year ahead as they were not yet ready to declare victory over inflation.

Disinflationary Trend (Annual Cpi %)

| Country | Nov-23 | Oct-23 | Peak in cycle |

| U.S.A. | 3.2 | 3.7 | 9.2 |

| EUROPE | 2.4 | 2.9 | 10.6 |

| U.K. | 4 | 6.7 | 11.1 |

However, a note of caution on assuming continued deflationary trend is warranted. Base effect was favouring lower indices in some countries and it was also helped by the sharp fall in energy prices which remain volatile and one cannot rule out a spike up with deliberate supply reductions through output cuts by oil producing countries. Another factor to be borne mind, which some FED members have been hinting at is that the easing of financial conditions and risk asset rallies (which create wealth effect can once again push up demand led inflation through higher consumption).

Global Economies

We saw refreshing news of some stability in economic updates from both China and Europe during the month, while U.S. economy continued to throw up mixed data. But on the overall growth rate, U.S. won the contest hands down as the second estimate of GDP for July-September quarter came at 5.2%, beating forecasts of 5% and previous quarter growth rate of 2.1%. Total output of goods and services grew at its fastest rate in nearly two years. Consumption, which accounts for 70% of the US economy rose 3.6% annual rate and Government spending rose 5.5% on annual basis, both of them accounting for the big rise in the GDP. In contrast, Europe continued to struggle with a growth rate of 0.1% vs. previous estimate of -0.1%, while UK recorded a flat growth for the quarter. In Europe both Germany and France recorded negative growth rate of -0.1%.

EU actually cut Eurozone 2023 GDP forecast to 0.6%, down from a Sep forecast of 0.8%. UK saw the flash reading of composite index jumping to expansion territory at 50.1 from 48.7 in October.

The reading indicated a stabilization of UK private sector output after marginal reductions in the previous three months.

| Country | U.S.A | EUROPE | U.K. | JAPAN | CHINA | INDIA |

| Particulars | current vs. prev | current vs. previous | current vs. prev. | current vs. prev. | current vs. prev. | current vs. prev. |

| GDP QOQ | 5.2 vs. 2.1% | -0.1 vs. 0.2% | 0 vs. 0.2% | -0.5 vs. 1.1% | 4.9 vs. 6.3% | 7.6 vs. 7.8% |

| Ind. Prod YOY | -1.7 vs. -0.9 | (5.1) vs. (2.2) | 0 vs. -0.5% | -4.4 vs. -4.4 | 4.6 vs. 4.5% | 5.8 vs. 10.3% |

| PMI Mfg. | 49.4 vs. 50 | 43.8 vs. 43.1 | 46.7 vs. 44.8 | 48.1 vs. 48.7 | 49.4 vs. 49.5 | 56 vs. 55.5 |

| PMI Services | 50.8 vs. 50.6 | 48.2 vs. 47.8 | 50.5 vs. 49.8 | 51.7 vs. 51.6 | 50.2 vs. 50.6 | 58.4 vs. 61 |

| Jobless rate | 3.9 vs. 3.8 | 6.5 vs. 6.5 | 4.2 vs. 4.2 | 2.6 vs. 2.7 | 5 vs. 5.2 | 10.5 vs. 709 |

| Headline Inflation | 3.2 vs. 3.7 | 2.4 vs. 2.9 | 4.6 vs. 6.7 | 3.3 vs. 3 | 0 vs. 0.1 | 4.87 vs. 5.02% |

| Core Inflation | 4.1 vs. 4.3 | 3.6 vs. 4.2 | 5.7 vs. 6.1 | 2.9 vs. 2.8 | 0.8 vs. 0.8 | 4.2 vs. 4.6% |

| Consumer Confidence | 102 vs. 99.1 | -16.9 vs. -17.9 | -24 vs. 0-30 | 36.1vs. 35.7 | 92.2 vs. 88.1 |

Japanese Economy

Shrank at its fastest annualized quarterly pace in two years in the July-September period, as rising domestic inflation weighed on consumer demand, adding to export woes as demand waned. In China, Data on Industrial Production and Retail Sales showed improvement for the second successive month adding to optimism of the second largest economy recovering. However, even so, the real estate downturn continued to drag down investment in fixed assets. Jobless rate was stable at 5% but there was no update on the youth unemployment rate, which hit a record high of 21.3% in June.

A general improvement in the manufacturing is observed although some economies still have a contraction. In Germany, for instance, industrial production dropped once again in September for the fifth consecutive month and Industrial production is now more than 7% below its prepandemic level, more than three years since the start of Covid-19. Employment component of the PMIs is weakening too, which is good news for the doves.

Housing Sector Remains Depressed

U.S. existing home sales dropped to the lowest level in more than 13 years in October as the highest mortgage rates in two decades and a dearth of houses drove buyers from the market. Barring a rebound in November and December, home re-sales this year are on track for their worst performance since 1992.

Bond Market

Bond Markets had their best month since 1980s sparking Cross-Asset rally. In a year in which little has gone right in the US bond market, November turned out to be a month for the record books. Yields plunged across economies with initial reaction coming to the weak unemployment report from USA and got downward movement after inflation rates were seen much lower than previous months. Even the leading indicators across economies showed a downward trend sparking expectation of early rate cut by the FED and ECB.

| Tenor | 2 Year | 10 Year | ||

| COUNTRY | Current | Prev. month | Current | Prev. month |

| U.S.A. | 4.55% | 4.73% | 4.33% | 4.92% |

| GERMANY | 2.81% | 3.07% | 2.45% | 2.81% |

| U.K. | 4.59% | 4.79% | 4.18% | 4.52% |

| JAPAN | 0.04% | 0.16% | 0.68% | 0.95% |

| INDIA | 7.26% | 7.32% | 7.28% | 7.35% |

As can be seen most countries saw lower yields as markets expect Central Banks to start easing rates much earlier. According to Fedwatchtool fed will cut rates by at least 0.25% as early as May 2024 (some even predicting March 2024), while in Europe rate cut is expected in April. Both Central Banks are expected to cut rates by up to 1% next year. The expectation of rate cut in UK is much further down the line as their inflation is still far higher than the target rate of 2%, though it has fallen substantially in recent months too. China is still on easing path to support the economy as their inflation is still low while investors are speculating on when the Japanese Central Bank will start raising rates (current expectation is for April 2024).

Equities

Yield plunge spurred advance in stocks, credit and emerging markets. Investors see scope for more gains with Fed cuts on horizon. Investors frantically bid up the price of shares igniting a powerful pan markets rally.

| MARKET | 1st Nov 2023 | 1st Dec 2023 | Change | % Change |

| DOW JONES | 33,081 | 36,425 | 3,344 | 10.11 |

| S&P500 | 4,205 | 4,593 | 388 | 9.23 |

| NASDAQ | 12,887 | 14,305 | 1,418 | 11.00 |

| GERMAN DAX | 14,851 | 16,397 | 1,546 | 10.41 |

| UK FTSE | 7,321 | 7,529 | 208 | 2.84 |

| CHINA COMPOSITE | 3,038 | 3,031 | -7.0 | -0.23 |

| JAPAN | 31,311 | 33,431 | 2,120 | 6.77 |

| INDIA NSE | 19,064 | 20,267 | 1,203 | 6.31 |

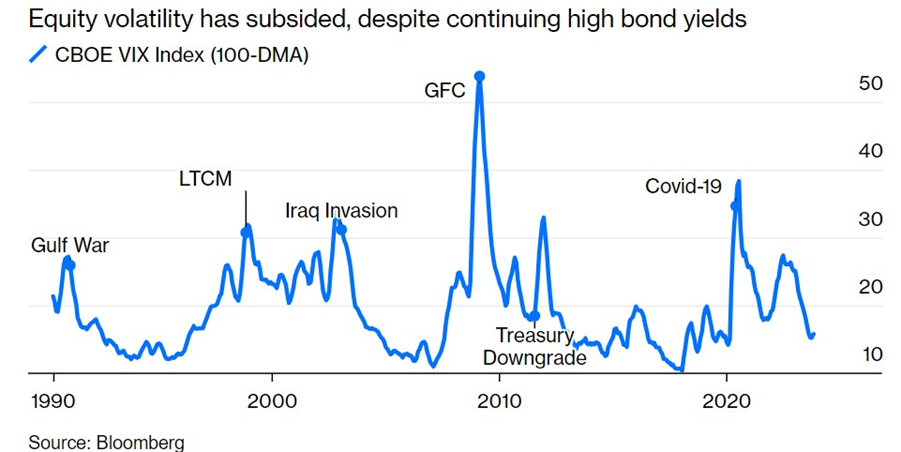

It is observed that equity volatility has fallen to multi-year lows (indication of complacency) with investors chasing stocks aided by abundant liquidity without regard to valuations.

Currencies

It was a weak month for the Dollar with DXY recording a sizeable fall of more than 3% with EURO and GBP making handsome gains, followed by Chinese Yuan, Yen and AUD.

| CURRENCY | 1st Nov 2023 | 1st Dec 2023 | Change | % Change |

| Dollar Index | 106.67 | 103.27 | -3.40 | -3.19 |

| EURUSD | 1.0577 | 1.0881 | 0.03 | 2.87 |

| GBPUSD | 1.2150 | 1.2700 | 0.06 | 4.53 |

| USDJPY | 151.31 | 146.81 | -4.50 | -2.97 |

| USDCNY | 7.32 | 7.14 | -0.18 | -2.42 |

| USDINR | 83.27 | 83.26 | -0.01 | -0.01 |

Fall in the Dollar was the direct result of US Yields falling and rising expectation of early rate cut by the FED. U.S. economy softening adds to these expectations, notwithstanding the GDP of 5.2% in Q2 which was ignored by investors, being a backward-looking data. Falling yield helped Yen to recover too which was a surprise, given the super-easy policy pursued by the Japanese authorities and promising to do more if economy required. At the same time, they kept voicing concerns on Yen weakness hinting at action. However, USDJPY fell without an actual intervention. The other surprise came when USDCNY fell nearly 3% which had twin reasons – economy showing tentative signs of stabilizing in some sectors and fall in US Yields narrowing the differential with China. The meeting between the Chinese Premier and President Biden on the sidelines of APEC meeting in U.S. was another trigger as markets perceived their meeting as a positive development.

Indian Economy and Markets

Indian economy continued to show its superior placement in the global picture. July-September GDP came at a forecast beating 7.6% (expected 6.8%) aided by higher consumption, manufacturing expansion and higher Government spending. The buoyant growth was underpinned by cyclical factors like robust corporate profits, a strong fiscal impulse, with government spending being front-loaded in a pre-election year, and a boisterous financial sector. This reading presents some upside to FY24 GDP, but growth is likely to moderate in the coming quarters as consumption growth is likely to slow post the festive season, and some slowdown in credit growth also expected.

Inflation moderated further, helped by drop in vegetable prices and some favorable base effect. It is likely to remain volatile due to big influence from food prices. Due to Government subsidy fuel inflation trended lower. While the inflation has been within the overall band of 2-6% mandated to the MPC, RBI Governor has recently reiterated that 4% is what the Central Bank is focused on. Meanwhile, the WPI index continued to show deflationary trend.

With growth remaining strong, we expect MPC to remain on vigilant mode and keep policy unchanged and maintain the stance of withdrawal of accommodation.

India’s merchandise trade deficit hit a new all-time high of USD 31.46 bio, vs. forecast figure of USD 20.50 bio.

| Particulars | Oct-23 | Sep-23 | Oct-22 | |

| Merchandise | Exports | 33.57 | 34.47 | 31.60 |

| Imports | 65.03 | 53.84 | 57.91 | |

| Services | Exports | 28.70 | 29.37 | 25.30 |

| Imports | 14.32 | 14.91 | 31.51 | |

| Overall Trade (Merch. + Serv.) | Exports | 62.26 | 63.84 | 56.90 |

| Imports | 79.35 | 68.75 | 71.42 | |

| Net Trade Balance | -17.09 | -4.92 | -14.52 |

All figs. In USD Bn

As can be seen from the above tables, deficit has been higher both on a YoY basis and MoM basis and even the net deficit (Merchandise + Services) shows a jump of over USD 12 bio compared to September. Major contributing factor for the big rise in deficit is gold imports which rose by 95% during October (with festival season demand impacting) and the rise in crude prices since September which is reflected in October deficit. While exports have actually dropped slightly, imports have surged by USD 11.18 bio. On YoY basis, however, exports have shown an increase both on merchandise and services.

Indian stocks gained over 6% during the month, helped by higher GDP growth and a strong rally following the state election results.

Despite various positives going for the economy, the INR remained on the weaker side as strong demand unmatched by supplies from flows, kept the upward pressure on the Dollar. The recent improvement in global factors like fall in US Yields, USD index falling, improvement in China Yuan and lower oil prices have not helped Rupee to move away from its weakest levels.

Surprisingly, the good GDP number last week and the state election results which indicate a possible stable government formation in next general election has also been ignored by the Rupee. At the same time, upside of the USD has also been limited due to the persistent intervention from RBI.

Outlook

Global markets have seen good two-way volatility during the year in all segments (yields up and down, stocks down and up while the Dollar has seen alternating bouts of bullish and bearish plays. As we step into the last month of the calendar year, the volatility is expected to decline with a lot of suspense regarding the Central Banks’ monetary policy approach in response to the fall in inflation and weakening economies. In the past, we have seen that rate cuts happen when there is a systemic crisis or when the economy slumps big. Hence we expect Central Banks to maintain their neutral and data dependent tone for some more time.

Going forward, the fiscal situation of the U.S. is likely to become a big headwind for the global markets as their deficit has risen by 23% this year. US debt interest bill has also rocketed past $1tn a year. It’s 4% of annual US GDP having doubled in 19 months. It is equivalent to 16.3% of the entire Federal budget for fiscal year 2022. While the heavy borrowing due to the same keeps the yields supported, in medium term this may result in a big depreciation in the value of the Dollar.

Taking note of the severe fiscal situation of the US government, Moody’s Investors Service signalled it was inclined to downgrade the nation because of wider budget deficits and political polarization. The rating assessor lowered the outlook from stable while affirming the nation’s rating at AAA, the highest investment-grade notch. Amid higher interest rates, without measures to reduce spending or boost revenue, fiscal deficits will likely “remain very large, significantly weakening debt affordability,” Moody’s said. This did not have an immediate impact on the markets as FITCH another rating agency had already done it back in May this year. However, it does have a negative medium term implication and add to a depreciation tendency for the Dollar.

Indian Rupee Outlook

State election results – encouraging for investments

The final results of the elections announced for four of the five state assemblies that went to the polls declared on 3rd December did spring a surprise which can turn to be a positive for the Indian financial markets including the Rupee. The BJP which was expected to win only one State out of the five, run a close contest in another and lose the remaining, ended winning three of the four with clear majority. This has not only beaten all forecasts (just like many of the US economic numbers have been) but has significance for the political development in the next few months when Parliamentary elections will be held. Going by the current popular support, the ruling party at the centre could do well and ensure a stable government for third time running, which will be a huge positive for the investors.

Global investors who had been holding in check much of their investments in last few months in view of the possible uncertain political situation would heave a sigh of relief at these election results. A positive view taken by them can result in fresh inflow of funds into the Indian market, and more importantly to the FDIs that will relieve a lot of pressure on the Rupee which may actually start to strengthen.

In the short term, however, rupee is likely to remain under pressure due to lack of flows and higher deficits.

Technical Outlook

USDINR

The range for the currency pair continues to narrow, although with a new high due to technical glitch once. The pair as long as continues to trade in the range 83.00 and 83.40 should be looked as the range extremes and suitable actions around these levels should be taken for risk management purposes.

Commodity Outlook (Gold)

GOLD: COMEX: XAUUSD: CMP: USD 2025

Gold broke above its all time high, resisted thrice earlier in the past 3 years (USD 2070), in a thin early Asian market with less liquidity. The prices then corrected in its follow through during the day with profit taking actions in sight. The metal gave up gains during the day to close back below the USD 2070.

The metal is expected to remain bullish in as the US Real Yields start to decline again, making way for the metal to rally. Buy on dips can be the suggested action for gold with a rise in the uncharted territory to be seen again during the month.

Supports around USD 2000 and USD 1960 to hold any downside action for the month. The metal is expected to move upside with eventual targets around USD 2260 and USD 2300 in the next 36 months’ timeline.

Even against INR, the precious metal made a new all-time high breaking above 61850 levels in the last week sustaining well above these levels. Support for the commodity against INR is expected around INR 61,250 and then around INR 59,600 (less likely to see prices beyond these levels).

The expectations primarily continue to be bullish for new highs to be seen in the coming few months. Initial resistances are expected to be at INR 64200 although this is further expected to be broken for a next move towards INR 68,300 levels in the next 3 months.

The break of ATH and decrease of Real Yields have most likely kickstarted a new bull run for the precious metal in the longer time frame.